We have fully obligated the remaining funds for the Monterey County Emergency Rental Assistance Program. Because of this, United Way Monterey County is no longer accepting new applications or requests for additional payments for the program.

Beginning in 2023, some Emergency Rent Assistance funding was shifted to support Housing Stability programs. These programs provide support for housing unstable Monterey County families allowing them to maintain or obtain stable housing.

Specific program services include but are not limited to:

- Providing financial assistance such as assistance with the deposit, move-in fees, storage fees, or application fees, to obtain stable housing

- Case management services to help a client maintain or obtain housing and support financial stability

- Housing navigation services to connect families with available housing

- Mediating between landlord and tenant on lease agreement disputes

- Assistance with obtaining a housing voucher and other public benefits

- Making closed-loop Smart Referrals

- Other services as deemed appropriate by Grantee.

Participating Agencies Include:

- City of Salinas

- Harnell College Foundation

Success Story

A self-referred Member of the Opportunity Platform enrolled in early 2023 seeking assistance to obtain stable housing. The Member had relocated from Oklahoma to California in 2018 and had been struggling since. They worked one-on-one with the Resource Specialist in different areas, including creating a functional budget, credit score improvement, and retirement plan contribution.

Through the Member's commitment and persistence, they obtained a 2-bedroom apartment with partial rental assistance for six months. During the six months of assistance, the Member worked closely with the Resource Specialist to find an alternative solution when the assistance ended.

A month before the six-month period ended, the Member received a call from the Housing Authority to notify her approval of Section 8. The Member was now looking for a new place to call home. While searching for a new home, they faced several obstacles, one being that they needed to figure out if they would need to break the lease or renew with the voucher. The Memeber's ultimate goal was to find a stable home for themselves and their three children. In late September, the Member found an eligible home that fit the criteria they were looking for. After applying, being approved, and speaking to the property manager, the Member was worried they would be unable to move in due to not having the complete deposit after paying the fees to break the current lease.

The Resource Specialist informed the member that the Housing Stability program could provide direct assistance. A revised budget and plan were created to cover all the expenses that would arise. In early October 2023, the Housing Stability program provided $5,250 to cover the deposit.

The Member and their family have gone from renting a small apartment to a four-bedroom house their family now calls home! They closely follow the budget to maintain their now-stable housing. Together, the Member and the Resource Specialist have begun to map our new, long-term goals for 2024, including taking steps to prepare to become a homeowner.

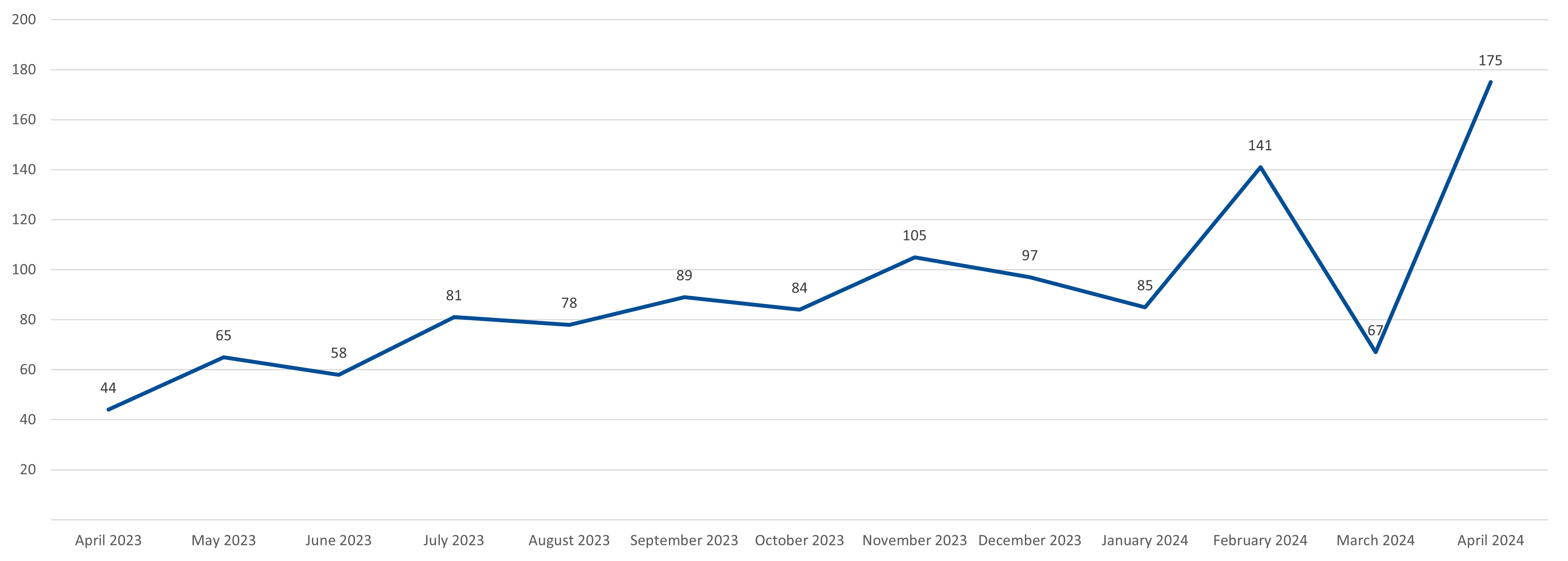

Number of Households Served

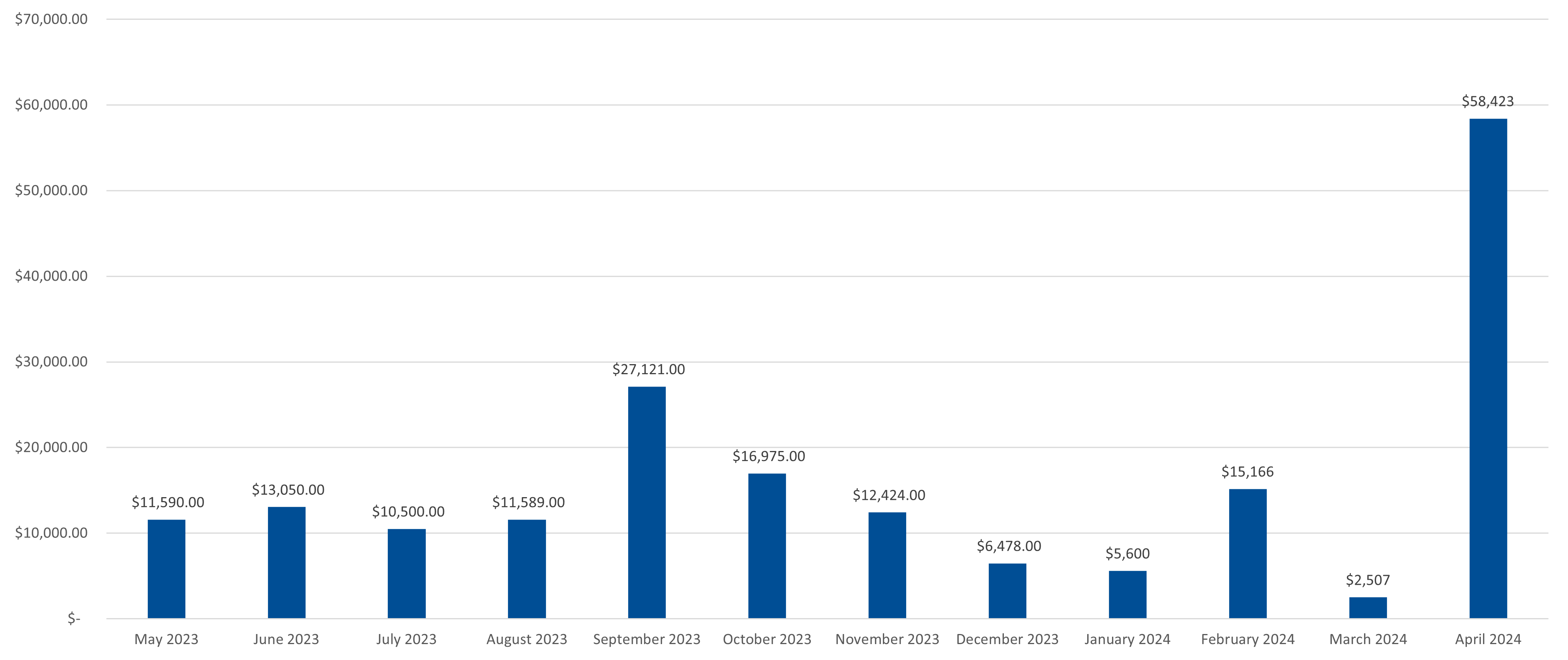

Deposit Assistance Paid

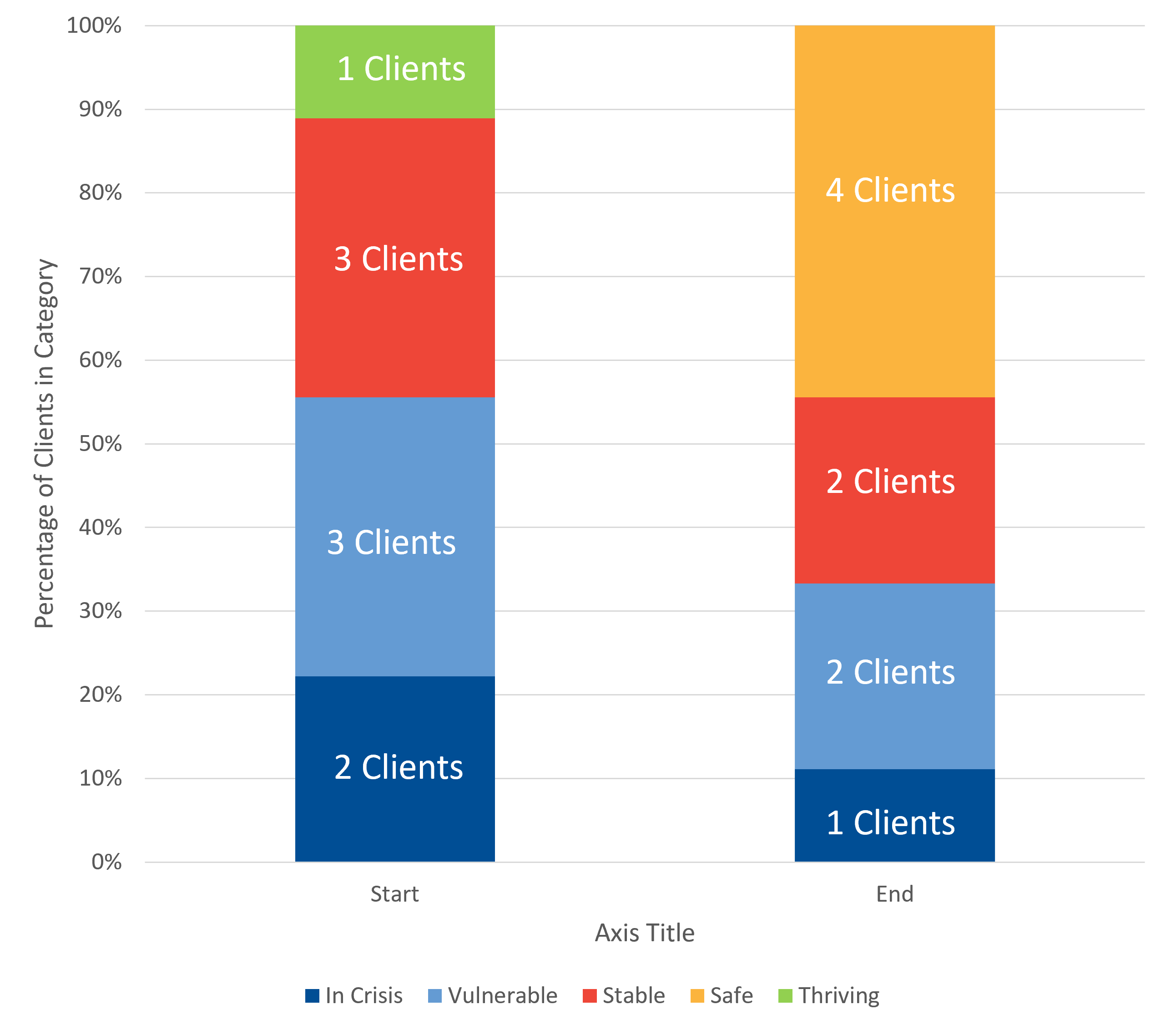

Greenfield Economic Mobility

February 1, 2023-February 14, 2024

City of Greenfield Housing Stability Success Story:

City of Greenfield Housing Stability Success Story:

One anonymous Case Study Success Story that highlights how the City of Greenfield Services has supported clients to achieve their ERAP goals.

A resilient mother, residing with her three daughters in a challenging living situation, sought assistance at City Hall after becoming aware of the Housing Stability Program. Renting a room in a trailer for $1,100, she faced a hostile landlord who opposed the family leaving their confined space in the bedroom, creating a toxic environment.

She had been on a waitlist for affordable housing for 4 years, and she finally received a letter that her name was coming up closer to the top of the list. But we did not know how much longer that would take. With the help of her church, the single mother was able to find a man that had recently converted his garage into a studio, and he was willing to rent it to her for $1,100. Despite the desire for a more spacious home, we recognized the urgency of her situation, and we provided the crucial support of deposit and first month’s rent. This enabled her to escape the detrimental trailer environment and move into a larger, private space more suitable for her family.

A couple months later, she finally got the call from the Affordable Housing apartments offering her a 3-bedroom apartment, priced only slightly higher than the studio. Once again financial constraints hindered her ability to pay the security deposit. We did not want her to lose out on this opportunity, so we supplied the funds for the deposit on this apartment.

While the client faces ongoing financial challenges, working seasonally in agriculture, she expressed deep gratitude for the Housing Stability Program. The program not only provided her family with a suitable place to live but also individual rooms for her daughters to study and rest peacefully, significantly improving their overall well-being.

To learn more about programs, contact the participating agencies,

call 211 or self-refer via chatbot at 211montereycounty.org.

Program Eligibility:

- Resident of Monterey County

- Income Eligibility:

| Number of people in a Household | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| Acutely Low | $10,550 | $12,050 | $13,550 | $15,050 | $16,250 | $17,450 | $18,650 | $19,850 |

| Extremely Low | $25,300 | $28,900 | $32,500 | $36,100 | $39,000 | $41,900 | $45,420 | $50,560 |

| Very Low Income | $42,150 | $48,200 | $54,200 | $60,200 | $65,050 | $69,850 | $74,650 | $79,500 |

| Low Income | $67,450 | $77,100 | $86,750 | $96,350 | $104,100 | $111,800 | $119,500 | $127,200 |

| Median Income | $70,300 | $80,300 | $90,350 | $100,400 | $108,450 | $116,450 | $124,500 | $132,550 |

| Moderate Income | $84,350 | $96,400 | $108,450 | $120,500 | $130,150 | $139,800 | $149,400 | $159,050 |